Full health and travel insurance for borderless living

$161.50/month for ages 18-39, in USD

Complete healthcare

Including hospitalizations, emergencies and surgeries, plus preventative care, mental health support and maternity

Global

coverage

See any licensed provider at any clinic or hospital, private or public

Fast and simple claims

Tell us what happened and get your money back within a few days

24/7 human support

Our friendly customer care specialists respond in less than a minute via live chat.

.png?width=2000&name=beach-scene.df4e4e50%20(1).png)

Pricing calculator

See how much Nomad Insurance will cost for you and any immediate family members. Check who you can add to your plan

Sign up until age 64, and once enrolled, your coverage is renewable indefinitely.

You can add your spouse or children during sign up. Kids’ plans cost up to 35% less.

Paid monthly

12-month commitment

- Base coverage $161.50

- Hong Kong, Singapore & US $810.00

- Dental coverage $

- Electronics theft $216.00

Paid monthly

12-month commitment

- Base coverage $161.50

- Hong Kong, Singapore & US $810.00

- $

- Electronics theft $216.00

Explore what’s covered

- hospital stays

- nursing care

- ambulance for hospitalization

- diagnostics like MRIs

- extended care after hospital

- emergency dental (up to $1000)

- and more...

The Complete plan does not cover pre-existing conditions.

The travel portion of the Complete Plan is underwritten by SafetyWing Insurance II, a Puerto-Rico domiciled international insurer, sold, managed, and administered by SafetyWing MGA, ltd., a registered MGA in the Turks and Caicos Islands and offered exclusively to members of the SafetyWing Special Purpose Trust based in Puerto Rico

The health portion of the benefit plan is underwritten by VUMI® Group, I.I. (VUMI®), a Puerto Rico domiciled international insurer, administered by VIP Administration Services LLC, and offered in partnership with SafetyWing.

- hospital stays

- nursing care

- ambulance for hospitalization

- diagnostics like MRIs

- extended care after hospital

- emergency dental (up to $1000)

- and more...

Amazing service from safetywing. I was diagnosed with an acute hernia. Everything was settled within a day, operation the next day everything went smooth they even found a second hernia. Finally I found an insurance company who is in it for the customer instead of the money. Highly recommended 5/5

The representatives are very professional! I can guarantee that all my claims have been completed and processed in less than the estimated time they normally provide. The customer support team is definitely outstanding, they always go above and beyond to resolve any issues or concerns I have.

The system is intuitive, the insurance works well, you can always count on the support team. Highly recommended!

Simple. Reliable. Efficient. Responsive. I've been with them for 2 years now. I just love the no fuss experience. I just added my daughter for a new subscription policy. They gifted me a $20 voucher.

SafetyWing had my back when I smashed a motorcycle in Thailand and needed 2 surgeries and rehab abroad. Highly recommended.

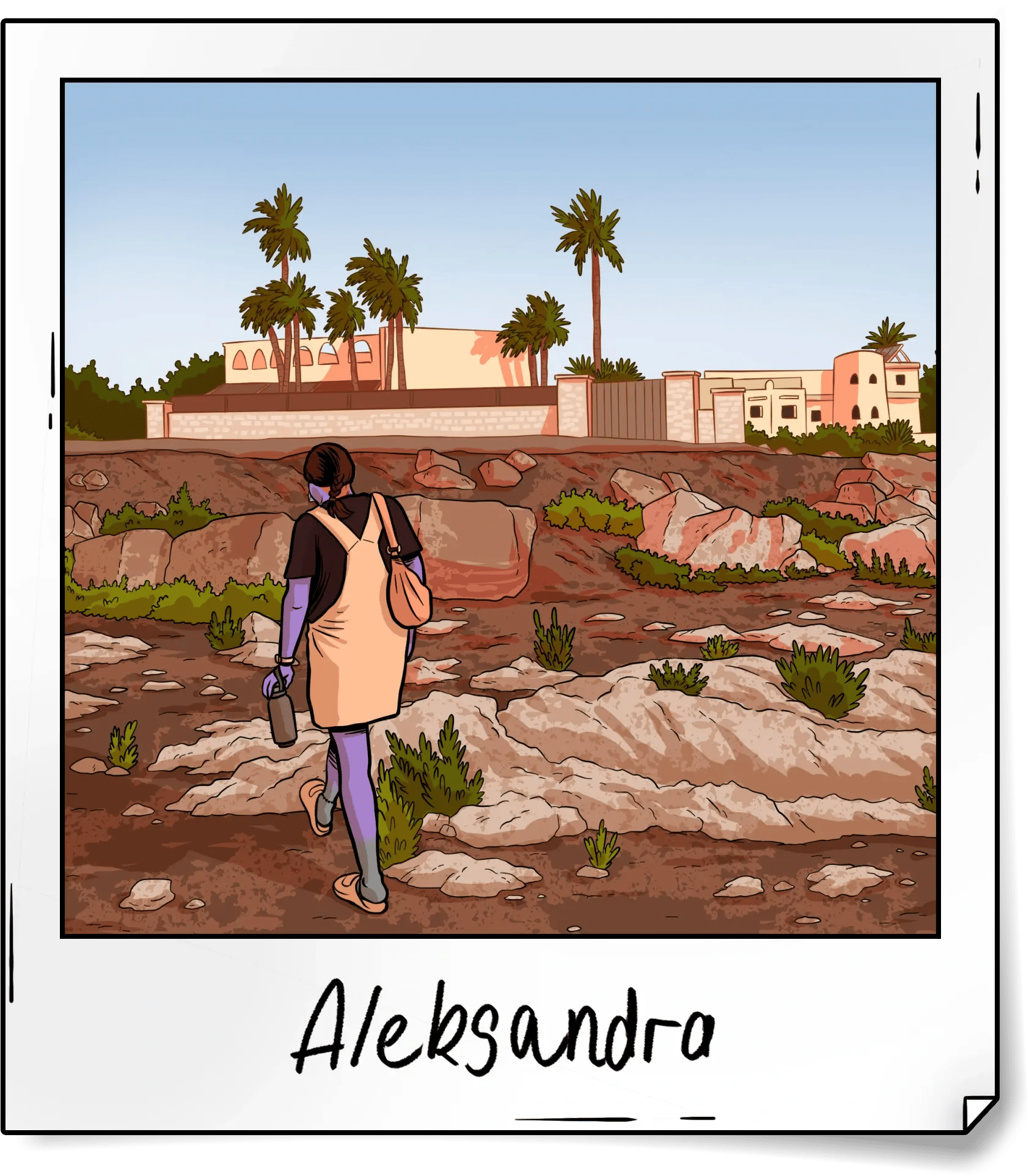

SafetyWing gives me the coverage and peace of mind I need while exploring. I never leave home without travel insurance. You shouldn't either.

Frequently asked questions

When does my coverage start if I buy Nomad Insurance Complete today?

It takes up to 10 days to process your application. Once approved, coverage starts on the 1st or 15th of the month, whichever comes sooner.

I already have Nomad Insurance Essential — how can I switch to Complete?

When you start a new Complete plan, your current plan will be automatically cancelled and refunded for the unused days as long as there are no ongoing claims. If your application is not approved, you will keep your current Essential coverage with no changes.

What do I need to submit a claim?

Log into your SafetyWing dashboard and click "Make a claim.” Fill out a short form and upload your documents, receipts, and medical notes stating the treatment you had and why. Typically, claims are reimbursed in 21 days or less. If we need more information to process your claim, we will reach out through email.

What are pre-existing conditions and why aren't they covered?

A pre-existing condition is any illness or injury for which you received treatment or diagnosis in your life, and any illness or injury you have experienced symptoms in the last two (2) years.

Why we don't cover them

In general, covering pre-existing conditions would vastly increase the price of the insurance, as we would have to cover everyone’s existing health issues. By excluding pre-existing conditions, we can keep prices lower and focus on covering new, unexpected health issues that arise after the plan starts.

Can I cancel my plan during the 12-month contract?

Complete plans are a 12-month commitment. You can request cancellation within the first 15 days of your coverage starting or when it renews.

If you cancel midway through your contract, you may only be refunded up to 65% of any coverage you paid for but didn’t use, unless you have a qualifying life event (i.e., you get married and get added to your spouse’s health insurance), in which case you will be refunded in full.

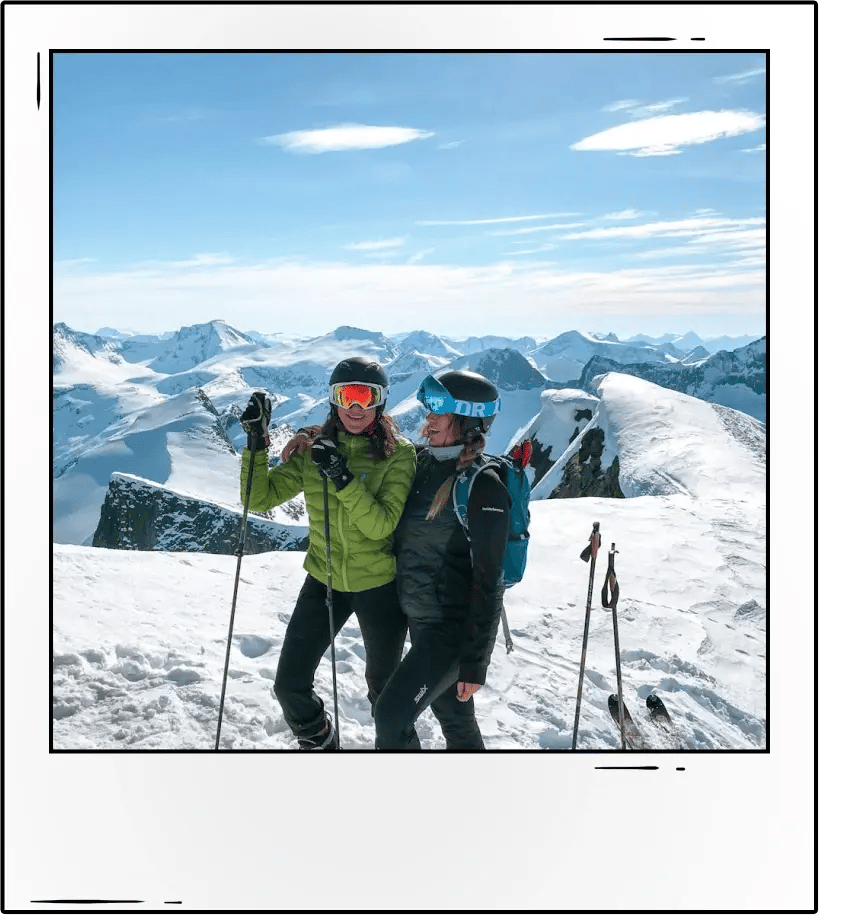

.png?width=2000&name=snow-trees.0588b391%20(1).png)

.png?width=2000&name=characters.65150dda%20(1).png)

.webp?width=129&height=129&name=Subtract%20(1).webp)